Indian Startup Funding: Q3 2023 Insights

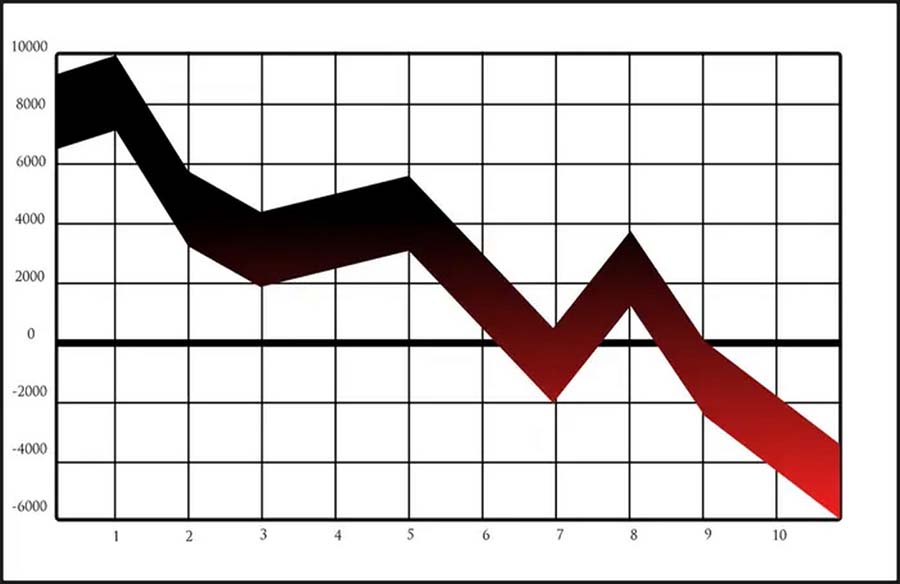

A recent report by Tracxn reveals that Indian startup funding experienced a significant downturn in the third quarter of the calendar year, hitting a five-year low. According to the report, startups managed to raise only $1.5 billion in Q3, marking a nearly one-third decrease compared to the previous quarter and a halved amount year-on-year.

Funding Landscape

Early-stage and seed-stage funding bore the brunt of the decline, plummeting by 74% and 75% respectively on a year-on-year basis. In contrast, late-stage funding rounds saw a comparatively modest reduction of 33%.

Abhishek Goyal, co-founder of Tracxn, noted, “Despite the decline in funding, India remains among the top-performing tech ecosystems globally.” He highlighted a promising trend of month-on-month funding growth, with an impressive 91% increase from $376 million in August 2023 to $720 million in September 2023.

Sector Performance

Fintech emerged as the standout performer, receiving $436 million in funding and witnessing a robust 68% quarter-on-quarter growth. This surge in investment can be attributed to the rapid adoption of UPI both domestically and internationally.

Meanwhile, enterprise applications funding experienced a 51% rise, whereas transportation and logistics tech faced a significant downturn, raising only $375 million, a drop of 72%.

Unicorn Status and Acquisitions

During the quarter, only two startups achieved unicorn status: Zepto and Zyber 365. These two companies collectively raised over $100 million each, contributing to the limited addition of unicorns in the quarter.

Additionally, the quarter witnessed 33 acquisitions, marking a 13% decrease from Q3 2022. Notable acquisitions included Route Mobile’s acquisition by Proximus Group for $718 million and Marico’s acquisition of Plix for $45.1 million.

Public Offerings and Investor Landscape

Several startups, including Drone Destination, Aha Solar, IdeaForge, and Veefin, went public during the quarter, signaling the growing maturity of the Indian tech ecosystem.

Accel, Blume, and Peak XV Partners emerged as the top investors of the quarter, with IPV, 100X.VC, and Titan Capital leading seed investments. In the early-stage category, Elevation, Tiger Global Management, and Accel dominated, while Glade Brook Capital took the lead in late-stage investments.

Neha Singh, co-founder of Tracxn, emphasized India’s resilience in the tech startup landscape, highlighting its fifth position in terms of funding in Q3 2023 and maintaining the fourth position in total funding for the year-to-date. These trends underscore the adaptability and resilience of India’s tech startups amid changing market dynamics.