Elon Musk’s xAI Funding Strategy

Elon Musk’s new AI startup, xAI, is attracting more investors through special purpose vehicles (SPVs) that come with substantial fees. Let’s delve into the details of this funding approach.

xAI’s Investment Offering

xAI is actively seeking investments at a pre-money valuation of $15 billion. The startup aims to secure $3 billion in external funding, which would push its post-money valuation to $18 billion. To achieve this, xAI is leveraging special purpose vehicles (SPVs) to pool investments from various venture capitalists (VCs) into a single entity.

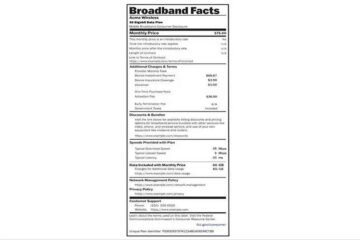

Terms for Investors

Investors interested in xAI’s funding round through SPVs must navigate certain terms and fees. Larger investments of $10 million or more grant investors a preferred position within an SPV, offering advantages on the cap table. However, this comes with upfront fees of 5% and a 1% management fee. Additionally, a carried interest of 10% is applicable.

Scaling Fees Based on Investment Size

The email outlining xAI’s funding terms suggests that fees may vary based on the investment size. For substantial investments, management fees could increase to 2%, and carried interest may rise to 20% under specific circumstances.

Funding Timeline and Investor Interest

The email sent to potential investors indicates xAI’s urgency in securing funds, expecting to close the financing within 2-3 weeks. It highlights significant investor interest, with many limited partners (LPs) eagerly awaiting this opportunity since December 2023.

xAI’s Current Operations

Despite its high valuation, xAI remains a relatively small operation with a limited team of around 10 engineers. The startup’s primary product, a chatbot named Grok, is trained using Twitter data, including Musk’s tweets, to mimic his conversational style.

No Response from xAI

As of now, xAI’s representatives have not responded to requests for comments regarding their funding strategy and operations.